Quick Guide to Options When Losing Employer-Sponsored Health Insurance

In Triage Health's free Quick Guide to Options When Losing Employer-Sponsored Health Insurance, you'll learn practical tips for comparing your options, and about COBRA, the Marketplace, Medicaid, and Medicare.

Approximately 50% of people in the United States get their health insurance coverage through their employer. What happens to your health insurance coverage if you leave, or lose, your job? There are a number of options that may be available. This Quick Guide covers the various options for comprehensive health insurance coverage that you might have, even if you have a pre-existing medical condition: COBRA, Marketplace plan, other group health plan, Medicare, or Medicaid. Because you may be eligible for more than one of these options, it is important to compare your options to determine which plan is best for you.

Comparing Your Options

There are a few key things to consider when picking a health insurance plan:

- What will the plan cost me?

- Are my health care providers and facilities included in the plan’s network?

- Does the plan cover my prescription drugs and any pharmacies I use?

When comparing plans, it can be tempting to just choose the one with the lowest monthly premium. However, to figure out the total cost for the year, including your out-of-pocket expenses, you need to do some math:

(Plan’s monthly premium x 12 months) + Plan’s out-of-pocket maximum = Total annual cost

You can use the Health Insurance Comparison Worksheet to compare your health insurance options. For an overview of health insurance basics and key terms to understand, read the Quick Guide to Health Insurance Basics or watch the animated videos on health insurance.

COBRA

COBRA is a federal law that allows eligible employees to keep their existing employer-sponsored health insurance plan after experiencing a “qualifying event.”

This chart lists the qualifying events that may entitle you to continued coverage under COBRA and the maximum length of time you can keep your plan. *There are two times when you may be able to extend COBRA coverage. There are also a few times when COBRA coverage may end early, such as when an employer stops offering health insurance coverage to all employees or when an employer goes out of business. For more information, read the Quick Guide to COBRA.

| COBRA Qualifying Event | Max. COBRA Coverage |

|---|---|

| Employment ends or hours reduced | 18 months |

| Loss of dependent child status (i.e., turning 26) | 36 months |

| Covered employee enrolls in Medicare (dependents like a spouse or child would be eligible for COBRA coverage) | 36 months |

| Divorce or legal separation from covered employee (dependents like a spouse or child would be eligible for COBRA coverage) | 36 months |

| Death of covered employee (dependents like a spouse or child would be eligible for COBRA coverage) | 36 months |

COBRA applies to private employers with 20 or more employees, or state or local governments. Federal employees have similar protections under a different law. Most states also have a state COBRA law that covers employers with 2 to 19 employees.

One of the main barriers to COBRA coverage is cost. Typically, you pay 100% of what your employer was paying for your coverage, plus a possible 2% administrative fee (for a total of 102%). However, there may be some benefits to choosing COBRA. For example, if you are in the middle of treatment, with COBRA coverage, you wouldn't have to find a new insurance plan that has the same coverage for your doctors, hospitals, and prescription drugs. Also, if you have already met your out-of-pocket maximum or deductible for the year, it may be less expensive to pay the higher COBRA premiums and not have any out-of-pocket costs for the rest of the year. You should do the math to figure out which option would cost you less.

You are required to choose COBRA within 60 days of your qualifying event. If you wait until the 59th day, you would have to back-pay the premiums for the two prior months, but any medical care that you received during that time would be paid for by your COBRA plan. If you need financial assistance for your COBRA premiums, the Health Insurance Premium Payment Program (HIPP) may help. If you qualify for Medicaid, but have access to a group plan through an employer (e.g., COBRA), Medicaid may pay your monthly premium for the group plan. To see if this is an option in your state, visit TriageHealth.org/StateResources.

Marketplace

You may be eligible to buy a plan through your state’s Health Insurance Marketplace Created by the Patient Protection and Affordable Care Act (ACA). Employees who are eligible for COBRA, are also typically eligible for a Special Enrollment Period (SEP) to buy a plan, from a private health insurance company, through their state’s Marketplace. The SEP gives you 60 days from the loss of your employer coverage to buy a new plan in the Marketplace. Plans sold in the Marketplaces are for a calendar year, meaning they typically go from January 1 through December 31. If you pick a plan mid-year, you will need to renew your plan or enroll in a new plan for the next calendar year, during the Fall open enrollment period.

There are benefits to buying plans through the Marketplace. For example, plans sold in the Marketplace cannot have an out-of-pocket maximum higher than $10,600 for an individual or $21,200 for a family in 2026. There may also be some financial assistance based on household size and income level. There are two types of assistance: a premium tax credit that lowers your monthly premium to buy a plan and cost-sharing subsidies that lower your out-of-pocket costs like co-payments. Visit HealthCare.gov or find your state Marketplace at TriageHealth.org/StateResources.

Other Group Health Plan

You may be eligible for a SEP to move to a group plan that is available to you through another job that you might have, your spouse’s group plan, or if you are under the age of 26, you may be able to move to a parent’s group plan. Check the other employer’s plan for additional rules.

Medicaid

You may be eligible for Medicaid in your state. Medicaid is a federal health insurance program that provides coverage to individuals with a low-income level. If you live in a state that expanded its Medicaid program under the ACA and you have a household income under 138% of the federal poverty level ($21,597 for an individual in 2025), you may be eligible for Medicaid. If you live in a state that has not expanded Medicaid, eligibility is based on having a low income level, low resource level (e.g., assets), and meeting another category of eligibility, such as getting Supplemental Security Income (SSI). Currently, 41 states, including Washington, DC, have expanded their programs and 10 states that have not. Medicaid applications are accepted year-round. To apply, visit HealthCare.gov or find your state Medicaid agency at TriageHealth.org/StateResources.

| Expanded: 41 | Not Expanded: 10 |

|---|---|

| AK, AR, AZ, CA, CO, CT, DC, DE, HI, IA, ID, IL, IN, KY, LA, MA, MD, ME, MI, MN, MO, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SD, UT, VA, VT, WA, WV | AL, FL, GA, KS, MS, SC, TN, TX, WI, WY |

Medicare

If you are over the age of 65, or about to turn 65, you may also be eligible for Medicare. Medicare is a federal health insurance program that provides coverage for people ages 65+ and who are eligible for Social Security retirement benefits, have collected Social Security Disability Insurance benefits for 24 months, or have been diagnosed with ESRD or ALS. For more information, read the Extended Quick Guide to Medicare Basics.

Moving Forward

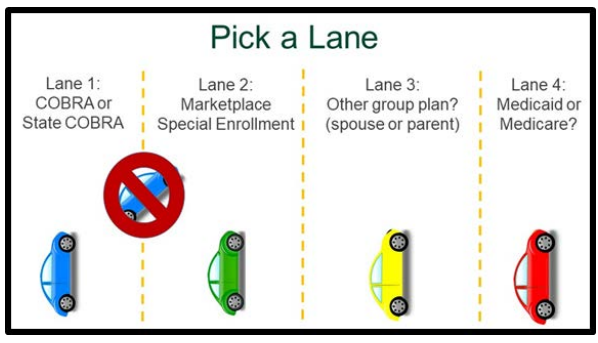

Choosing one of these options is like picking a lane to drive down. As you are comparing these options, remember there are deadlines and rules that apply. In many cases, once you pick a lane, you have to stay in that lane. For example, once you pick COBRA, you cannot switch to a Marketplace plan until the next Marketplace open enrollment period. The new Marketplace plan won’t begin until January 1, so, if you want continuous coverage, you need to keep the COBRA plan until then.

Choosing health insurance is not a one-time activity. You should review your options every year to ensure your plan meets your needs. A plan that met your needs in the past may not meet your needs in the future as your health changes over time. Open enrollment is the time of the year that people can change plans without penalty. The dates for open enrollment will depend on what type of health insurance coverage you have. For example, if you have an employer plan, then it varies, but many employers have open enrollment in the Fall for the plan year to start on 1/1. If you are buying a plan in the state Marketplace, open enrollment in most states is between 11/1 and 1/15. States that run their own Marketplaces may have a longer open enrollment. Starting in the fall of 2026 for the 2027 plan year, Marketplace open enrollment will be between 11/1 and 12/15, but states that run their own Marketplaces may extend open enrollment to 12/31. If you have Medicare, open enrollment is between 10/15 and 12/7 each year.

This Quick Guide was developed in collaboration with:

PP-ONC-USA-1555-01

Learn More

For more information about health insurance, visit TriageHealth.org/Health-Insurance and CancerFinances.org.

Sharing Our Quick Guides

We're glad you found this resource helpful! Please feel free to share this resource with your communities or to post a link on your organization's website. If you are a health care professional, we provide free, bulk copies of many of our resources. To make a request, visit TriageHealth.org/MaterialRequest.

However, this content may not be reproduced, in whole or in part, without the express permission of Triage Cancer. Please email us at TriageHealth@TriageCancer.org to request permission.

Last reviewed for updates: 01/2026

Disclaimer: This handout is intended to provide general information on the topics presented. It is provided with the understanding that Triage Cancer is not engaged in rendering any legal, medical, or professional services by its publication or distribution. Although this content was reviewed by a professional, it should not be used as a substitute for professional services. © Triage Cancer 2026