Quick Guide to Medicare Basics

In Triage Health's free Quick Guide to Medicare – Extended, learn about the parts of Medicare, types of plans, health insurance terms, Medicare costs, Medigap, considerations for picking a Medicare plan, types of pharmacies, tips for lowering drug costs, and more!

Medicare can be confusing. To understand your options and find coverage that’s appropriate for you, there are some basics that are helpful to know.

Medicare is a government health insurance program. To be eligible, you must: be 65+ years old; have collected Social Security Disability Insurance (SSDI) for more than 24 months; or have been diagnosed with end-stage renal disease (ESRD) or ALS.

Parts of Medicare

Medicare coverage is broken down into 4 parts:

- Part A: Hospital Insurance. Includes hospital care, skilled nursing facilities, nursing homes, hospice, and home health care.

- Part B: Medical Insurance. Includes outpatient services, preventive care, labs, mental health care, ambulances, and durable medical equipment.

- Part C: Advantage Plans. Part C is an alternative to Parts A and B and includes benefits and services covered under Parts A and B, and usually Part D. Plans are offered by Medicare-approved private insurance companies.

Part D: Prescription Drug Coverage. Plans are offered by Medicare-approved private insurance companies.

Part A and Part B are referred to as Original Medicare. For more details about the parts of Medicare coverage, read the Quick Guide to Medicare.

Types of Medicare Plans

There are two Medicare payment systems when you receive health care.

- Fee-for-service (FFS): a health care provider is paid a fee for each service provided. With FFS plans, you can go to any provider willing to see you. You pay for a portion of your care, and the insurer pays the rest. Medicare Parts A and B are considered FFS.

- Managed Care: a health care provider contracts with a health insurance company to be a part of its network. If you go to a provider in the network, the provider has agreed to a certain payment rate for treating you (i.e., allowed amount). Regardless of what the provider bills, it’s that “allowed amount” that will determine your final cost. You typically pay a portion of the allowed amount, depending on your plan. Medicare Parts C and D are managed care plans.

Types of Medicare Managed Care Plans

- Health Maintenance Organizations (HMOs): your health care services start with your primary care physician, and you usually need a referral before you can see any other health care provider, except in an emergency. For example, if you get a skin rash, you first go to your primary care physician. If needed, that physician will refer you to a dermatologist in your network. Generally, HMOs have smaller networks of providers, and providers outside of your network will not be covered by your HMO. While you may have fewer choices in providers, HMOs are often less expensive.

- Preferred Provider Organizations (PPOs): generally, you do not need to start with your primary care physician. While most PPOs have some out-of-network coverage, staying inside your network means lower out-of-pocket costs. Typically, PPOs cost more than HMOs, but you have more choice and control.

Health Insurance Terms

These are health insurance terms that you should understand:

Monthly premium: what you pay each month to have coverage – you pay these costs even if you never get medical care. It’s like paying for car insurance all year, but never filing a claim.

Then there are costs that you have to pay when you get medical care, often called “out-of-pocket” costs. The specific amount of those costs will depend on your Medicare plan.

- Annual deductible: a fixed dollar amount you pay out-of-pocket first, before Medicare kicks in.

- Co-payment: a fixed dollar amount you pay when you get medical care or a prescription. For example, when you pick up a prescription, you might have a $10 co-payment.

- Co-insurance (aka cost-share): a percentage difference in what Medicare pays for your medical expenses and what you pay for your medical expenses. For example, if you have an 80/20 co-insurance, the insurance company pays 80% of your medical expenses and you are responsible for 20% of your medical expenses, after paying your deductible. Medicare Part B has an 80/20 co-insurance.

- Out-of-pocket maximum: a fixed dollar amount that is the most that you will have to pay for your medical expenses out-of-pocket during the year. How much your out-of-pocket maximum is, will depend on your Medicare plan. It is a very important thing to find out! Generally, you reach your out-of-pocket maximum by paying your deductible, plus any co-payments that you make during the year, plus any co-insurance payments you make. So it’s everything that you pay, except your monthly premiums. Once you reach your out-of-pocket maximum, your insurance pays 100% of your medical expenses for the rest of the year. Medicare Part B does not have an out-of-pocket maximum. Medicare Part C plans have an out-of-pocket maximum, which is not allowed to be higher than $9,250 in 2026.

Medicare Costs

- Part A: If you have paid into Medicare while working over your lifetime, the monthly premium is free. If you haven’t paid into the system, the Part A monthly premium can be up to $565. The deductible per benefit period is $1,736. You may also be responsible for paying a cost-share amount depending on the number of days spent in a hospital.

- Part B: The Part B monthly premium is generally $202.90 (there are some exceptions for higher incomes) and there is a deductible of $283 per year. The co-insurance for Part B coverage is 80/20, which means that once you have paid your deductible, Medicare will cover 80% of your health care costs and you will be responsible for 20%. With Part B coverage, there is NO out-of-pocket maximum. If you enroll in Part B late, there will be a 10% penalty added to your Part B premium for each year you wait to enroll.

- Part C (an alternative to Parts A and B, and sometimes D): The premiums for this plan are usually at least the same as Part B ($202.90) or more, but vary based on the plan you chose. The deductibles, cost share, and out-of-pocket maximums will also depend on your plan.

- Part D: The premiums vary by plan (average cost = $34.50/month). Premiums are also higher for those with higher income levels. In 2026, the maximum deductible for a Part D plan is $615. After paying $615 out-of-pocket, Medicare covers 75% of your drug costs, and you pay 25%. Once your total out-of-pocket drug costs reach $2,100, you enter “catastrophic coverage” and won’t have to pay a copayment or coinsurance for covered Part D drugs for the rest of the calendar year. There is also a new Medicare Prescription Payment Plan, which allows you to spread out your costs over the year. If you do not sign up for a Part D plan when first eligible, you may pay a late enrollment penalty for life.

Medicare Supplemental Plans (AKA Medigap)

A Medigap plan is a supplemental insurance plan for those who choose Original Medicare (Parts A and B) that will help pay for “out-of-pocket” costs such as deductibles, co-payments, and co-insurance amounts. Plans are labeled A through N, and each plan with the same letter must offer the same basic benefits. The premiums and deductibles vary with each plan. If you choose Original Medicare, there is a 20% co-insurance amount for Part B, so a Medigap plan can help pay for that expense. If you buy a Part C plan, you are not eligible to buy a Medigap plan. For details, read Triage Health's Quick Guide to Medigap.

Considerations for Picking a Medicare Plan

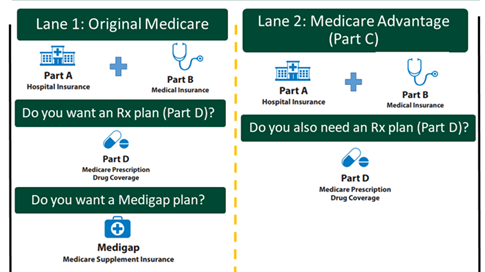

Finding the right Medicare plan can feel overwhelming. There are generally 2 lanes to choose from:

- Original Medicare with Parts A and B, plus you can choose a Part D plan, and you can choose a Medigap plan.

Medicare Advantage plan that includes the benefits of Parts A and B, and usually Part D. If the Advantage plan does not include Part D, then you can also choose a Part D plan.

There are a few key things to consider when picking a Medicare plan:

- What will the Medicare plan actually cost me?

- Do my health care providers and facilities take

- Medicare, and if I choose a Medicare

- Advantage plan, are they in the plan’s network of providers?

Does the Part C or Part D plan cover my prescription drugs and pharmacies I use?

When comparing plans, it can be tempting to just choose the one with the lowest monthly premium. But, to figure out the total cost for the year, including your out-of-pocket expenses, you have to do some math:

(Plan’s monthly premium x 12 months) + Plan’s out-of-pocket maximum = Total annual cost

Picking a Plan Example

Jamie is nearly 65 years old and is about to begin 1 year of IV chemotherapy treatments, which will cost $10,000 a month. Because the IV treatment will be provided in the doctor’s office, it will be covered under Medicare Part B. What would be her out-of-pocket costs?

Option 1: Original Medicare

- Part B monthly premium = $202.90 per month x 12 = $2,434.80

- Part B deductible = $283

- Part B co-insurance (just for her chemo) = ($10,000 x 20% = $2,000) x 12 months = $24,000

- Total for Part B and chemo cost-share = $26,717.80

Option 2: Original Medicare + Medigap Plan G (costs $300/month based on her age and where she lives)

- Part B monthly premium = $202.90 per month x 12 = $2,434.80

- Part B deductible = $283

- Part B co-insurance (just for her chemo) = $0 (paid for by Medigap plan)

- Medigap plan G monthly premium = $300 x 12 months = $3,600

- Total for Part B + Medigap Plan G = $6,317.80. Although there’s an additional monthly cost to buy a Medigap plan, it can save someone with an expensive medical condition thousands of dollars each year.

Option 3: Medicare Advantage plan with drug coverage (costs $83/month based on where she lives). This plan has an out-of-pocket maximum of $4,758.

- Part B monthly premium = $202.90 per month x 12 = $2,434.80

- Medicare Advantage monthly premium = $83 per month x 12 = $996

- Medicare Advantage co-insurance (just for her chemo) = ($10,000 x 20% = $2,000) x 12 months = $24,000 (but she only has to pay up to her out-of-pocket maximum of $4,758)

- Total Medicare Advantage (MA) Plan and chemo cost-share = $8,188.80. Although the MA plan is less expensive than Original Medicare (Option 1), Jamie is limited to only going to in-network providers.

For more information on how to pick your Medicare plans, including Part C, Part D, and Medigap plans, visit: Medicare.gov/plan-compare

Prescription Drug Terms

There are some additional terms that are helpful to understand about prescription drug coverage:

- Brand-name drugs: a prescription drug with a specific name from the company that sells the drug. At a point in the future, usually after a patent expires, a generic version of a drug may be available and sold by other companies.

- Generic drugs: a prescription drug that contains the same chemical substance as a brand-name drug.

- Specialty drugs: prescription drugs that have a high cost, high complexity, and/or require a high touch. Many drugs for cancer are considered specialty drugs.

- Formulary: a list of prescription drugs that a health plan will cover and for how much. Understanding and using a plan’s formulary will help you save money on medications. Some plans have formularies with two or more cost levels, known as tiers. A drug on a higher tier will have higher out-of-pocket costs for you. The highest tier in most formularies is the “specialty” tier, which includes many cancer drugs. The co-payment and co-insurance amounts will depend on the tier of the drug you are taking. For example, a tier 1 drug may have a $10 co-payment, while a tier 5 specialty drug may have a 30% co-insurance amount.

- Step therapy: when an insurance company requires patients to try a generic or lower cost drug before getting a brand-name or more expensive drug. If the lower cost drug doesn’t work or causes a bad reaction, the patient would be allowed to “step up” to another medicine. If your Part D plan uses step therapy, it is important to work with your health care team to show that taking a specific drug is medically necessary for you and why the insurance company should make an exception to their process.

Types of Pharmacies

There are different types of pharmacies that may be covered by your plan:

- Retail pharmacies: generally a physical location where you go to pick up your prescriptions.

- Mail-order pharmacies: some retail pharmacies also provide mail-order benefits, where you get your prescriptions in the mail. Some health plans require you to use a mail-order service if you have an ongoing prescription (e.g., a drug you will be taking for more than 2-3 months).

- Specialty pharmacies: a pharmacy that provides specialty drugs.

Tips on Lowering Drug Costs

- Understand your plan’s prescription drug coverage:

- Does your plan require that you get your drugs from an in-network pharmacy?

- Does your plan charge you less if you use a mail-order pharmacy?

- Understand your Medicare assistance programs:

- Understand the different types of help that pharmaceutical companies provide. The companies that make your medicines may provide support to help you understand your insurance coverage. Many of them also offer financial assistance resources such as free medication for eligible patients.

- Understand your other options for financial assistance:

- Does your state have a State Pharmaceutical Assistance Program (SPAP)?

- Visit Cancer Finances—an interactive toolkit for navigating finances after cancer: CancerFinances.org

Learn More

For more information on Medicare, visit TriageHealth.org/medicare/

Sharing Our Quick Guides

We're glad you found this resource helpful! Please feel free to share this resource with your communities or to post a link on your organization's website. If you are a health care professional, we provide free, bulk copies of many of our resources. To make a request, visit TriageHealth.org/MaterialRequest.

However, this content may not be reproduced, in whole or in part, without the express permission of Triage Cancer. Please email us at TriageHealth@TriageCancer.org to request permission.

Last reviewed for updates: 01/2026

Disclaimer: This handout is intended to provide general information on the topics presented. It is provided with the understanding that Triage Cancer is not engaged in rendering any legal, medical, or professional services by its publication or distribution. Although this content was reviewed by a professional, it should not be used as a substitute for professional services. © Triage Cancer 2026

This Quick Guide was developed in collaboration with:

PP-ONC-USA-1555-01