Quick Guide to Health Insurance Marketplaces

In Triage Health's free Quick Guide to Health Insurance Marketplaces, you'll learn why you should shop in the marketplace, financial assistance, Medicaid, enrollment periods, when your plan will start, how to report changes, and more!

The Patient Protection & Affordable Care Act (ACA) created a new way to find and buy private health insurance coverage for individuals and families: State Health Insurance Marketplaces. Originally called “exchanges,” the term “marketplace” refers to a place where you can find health insurance options from private insurance companies. These Marketplaces have been compared to an insurance shopping mall. The Marketplaces for most states are operated by the federal government at HealthCare.gov or 800-318-2596. Some states run their own Marketplaces. For example, if you live in California, you should access your Marketplace through CoveredCA.com. For other State-run Marketplaces, visit HealthCare.gov/marketplace-in-your-state.

Why Should You Shop Through the Marketplace?

There are real benefits to shopping for coverage through the Marketplace.

- Out-of-pocket Maximum: For 2025, Marketplace plans cannot have an out-of-pocket maximum more than $9,200 for an individual and $18,400 for a family. This cap is high, but is still lower than some employer plans, which can have higher out-of-pocket maximums. Also, out-of-pocket maximums for all Marketplace plans must include everything you spend for deductibles, co-payments, and co-insurance for in-network providers.

- Standardized Plans: Plans sold through the Marketplace are standardized by their level of cost-sharing:

- Bronze plans have a 60/40 cost-share, meaning that the insurance company pays for 60% of your medical expenses and you are responsible for 40% of your medical expenses. Bronze plans generally have the lower monthly premiums, but higher out-of-pocket costs.

- Silver plans have a 70/30 cost-share.

- Gold plans have an 80/20 cost-share.

- Platinum plans have a 90/10 cost-share, with higher monthly premiums, but lower out-of-pocket costs.

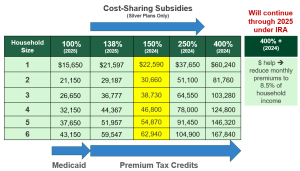

- Financial Assistance: Based on your projected income level for the next year, you may qualify for one or both forms of financial assistance. You may receive “premium tax credits,” which lower your monthly premium based on the plan you chose. And, “cost-sharing subsidies” can lower co-payment amounts, deductibles, and coinsurance amounts.

How Do You Qualify for Marketplace Financial Assistance?

The amount of financial assistance that you may qualify for is based on your household size and income level. Your household can include the following people:

- Your spouse, if you are currently married.

- Dependent children, including adopted and foster children, of any age.

- Children whose custody you have shared with someone else, only during the years you have claimed them as tax dependents.

- Non-dependent children under 26, if you want to cover them in your Marketplace plan.

- Children under 21 who you take care of and live with you, even if you do not claim them as tax dependents.

- Dependent parents, siblings, or other relatives, if you claim them as tax dependents.

Learn more about who to include in your household

Your income level is measured by your modified adjusted gross income (MAGI). It can be helpful to have IRS form 1040 handy while calculating your MAGI:

- Step 1: Calculate your gross income by adding together your various forms of income, including your salary or wages, rental and royalty income, business income, farm income, unemployment, and alimony received. You can also find this figure by checking line 7b of your IRS form 1040.

- Step 2: Calculate your adjusted gross income by subtracting qualified deductions. This number is also located on line 8b of IRS form 1040.

- Step 3: Calculate your MAGI by adding in any foreign earned income and housing costs for qualified individuals, tax-exempt income, and monthly Social Security benefits.

Expanded Medicaid:

These states that have expanded access to Medicaid under the ACA, providing coverage for people with household incomes up to 138% of the federal poverty level: AK, AR, AZ, CA, CO, CT, DC, DE, HI, IA, ID, IL, IN, KY, LA, MA, MD, ME, MI, MN, MO, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SD, UT, VA, VT, WA, WV.

If you live in a state with expanded Medicaid:

- Household income up to 138% of the federal poverty level (FPL): You have access to Medicaid.

- Household income between 138-250% FPL: You have access to premium tax credits and cost-sharing subsidies (if you pick a silver health insurance plan).

- Household income under 150% FPL: You are eligible for a Marketplace plan for less than $10 per month.

- Household income between 250-400% FPL: You have access to premium tax credits.

- Household income above 400% FPL: You can buy a Marketplace plan, but you will not qualify for financial assistance, unless your premiums cost you more than 8.5% of your household income. Note: this is a special rule only through 2025. Some states may provide additional assistance.

Note: the FPL numbers for the current year are used to determine Medicaid eligibility. The FPL numbers for the previous years are used to determine Marketplace financial assistance.

If you live in a state without expanded Medicaid (AL, FL, GA, KS, MS, SC, TN, TX, WI, WY):

- Household income between 100- 138% FPL: You have access to cost-sharing subsidies (silver plans only).

- Household income between 138- 250% FPL: You have access to premium tax credits and cost-sharing subsidies (if you pick a silver health insurance plan).

- Household income under 150% FPL: You are eligible for a Marketplace plan for less than $10 per month.

- Household income between 250-400% FPL: You have access to premium tax credits.

- Household income above 400% FPL: You can buy a Marketplace plan, but will not qualify for financial assistance, unless your premiums cost you more than 8.5% of your household income. Note: this is a special rule only through 2025.

Also new:

There is a new, monthly special enrollment period (SEP) for consumers with a household income under 150% of the FPL, to enroll in a Marketplace plan anytime during the year. States that run their own Marketplaces can choose to offer this SEP or not.

When Can You Buy a Marketplace Plan?

Although Medicaid applications are accepted all year round, there are two Marketplace enrollment periods: the Open Enrollment Period (OEP) and the Special Enrollment Period (SEP).

The 2025 Marketplace OEP is from November 1, 2025, through January 15, 2026. The earliest plans can begin is January 1. If you want your plan to begin on January 1, 2026, you must enroll by December 15, 2025. States that run their own Marketplaces may have different OEPs. Visit your state's marketplace for more information.

When you lose coverage or have a life-changing event, you may qualify for a SEP. You can enroll in a Marketplace plan through a 60-day SEP, for reasons that include:

- Loss of health insurance

- Losing employer-sponsored coverage (including end of COBRA)

- Losing eligibility for Medicaid, Medicare, or CHIP

- Losing coverage through a family member

- Changes in residence

- Moving to a new ZIP code or county

- Student moving to/from school

- Changes in household

- Marriage (chose plan by last day of month and coverage will start first day of next month)

- Birth of a baby, adoption of a child, or placement of a child in foster care (coverage starts day of event, even if you enroll in plan up to 60 days later)

- Divorce or legal separation (if this results in losing health insurance)

- Death of someone on your Marketplace plan

Note: You may have other options if you lose employer-sponsored health insurance coverage. For details, watch our Animated Video on Options When You Lose Your Insurance at Work, or read our Quick Guide to Options When Losing Employer-Sponsored Health Insurance.

When Does a Marketplace Plan Start?

If you enroll during open enrollment, by December 15, in most states, your coverage will begin on January 1.

If you enroll during a special enrollment period, and enroll by the 15th of the month, coverage will be effective on the 1st of the following month.

- For example: Enroll May 4, coverage will be effective June 1

However, if you enroll between the 16th and the last day of the month, coverage will be effective on the 1st of the second following month.

- For example: Enroll May 18, coverage will be effective July 1

How Do You Report Changes to the Marketplace?

Changes in your income, household members, name or other identifying information, and status (disability, tax filing, citizenship/immigration, etc.) should be reported to the Marketplace. There are three ways to report these changes:

- Update your application online: By logging into your HealthCare.gov account, selecting your application, clicking “Report a Life Change,” and following the prompts, you can update your application immediately.

- Update your application by phone: Contact the Marketplace at 800-318-2596.

- Update your application with in-person help

Tools to Help You Pick a Health Insurance Plan

Triage Health offers a series of animated videos that describe key issues that people need to understand to effectively navigate health-related legal and practical issues, as well as manage the financial burden of a medical diagnosis. These videos cover topics related to health insurance, employment, disability insurance, estate planning, clinical trials, cancer survivorship care plans, and more.

Watch the videos at: TriageCancer.org/AnimatedVideos

Triage Health Tools: Health Insurance Comparison Worksheet

Learn More

For more information, visit our Health Insurance Materials & Resources, and CancerFinances.org.

Sharing Our Quick Guides

We're glad you found this resource helpful! Please feel free to share this resource with your communities or to post a link on your organization's website. If you are a health care professional, we provide free, bulk copies of many of our resources. To make a request, visit TriageHealth.org/MaterialRequest.

However, this content may not be reproduced, in whole or in part, without the express permission of Triage Cancer. Please email us at TriageHealth@TriageCancer.org to request permission.

Last reviewed for updates: 02/2025

Disclaimer: This handout is intended to provide general information on the topics presented. It is provided with the understanding that Triage Cancer is not engaged in rendering any legal, medical, or professional services by its publication or distribution. Although this content was reviewed by a professional, it should not be used as a substitute for professional services. © Triage Cancer 2025